On 30 January 2023, Micro-Mechanics Holdings Limited (“MMH”) have announced the half year results for 2023. The results have shown a downtrend, which is not unexpected given the slower growth for the global semiconductor industry in the coming months.

It would also appear that the markets are pricing in a cut in dividends for FY2023, which is not unexpected given that they are on track to have insufficient earnings to cover a similar payout as 2022. There is potential for share price to continue to fall and provide attractive opportunities for investors to enter.

All things considered, I think that with China’s U-turn in their zero covid policy, there is a chance for them to continue growing their business and improve their financials. MMH with their zero debt will likely to be able to survive the worse of FY2023 and emerge stronger in the subsequent years.

Website: Financial Statements And Related Announcement::Half Yearly Results

Background

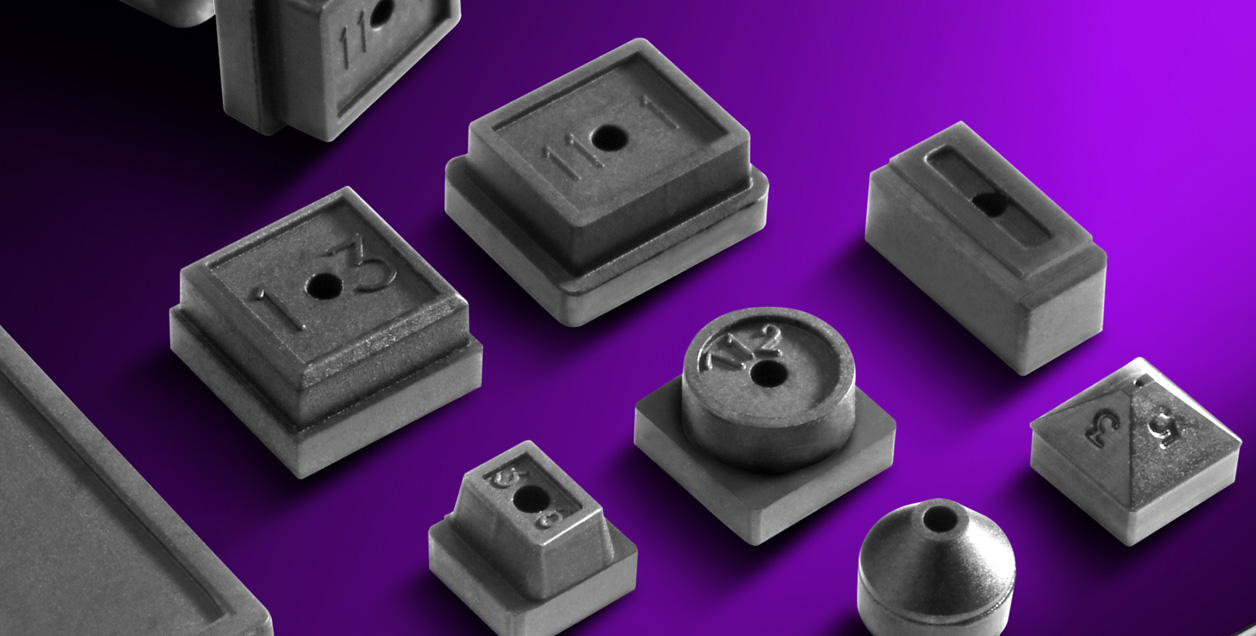

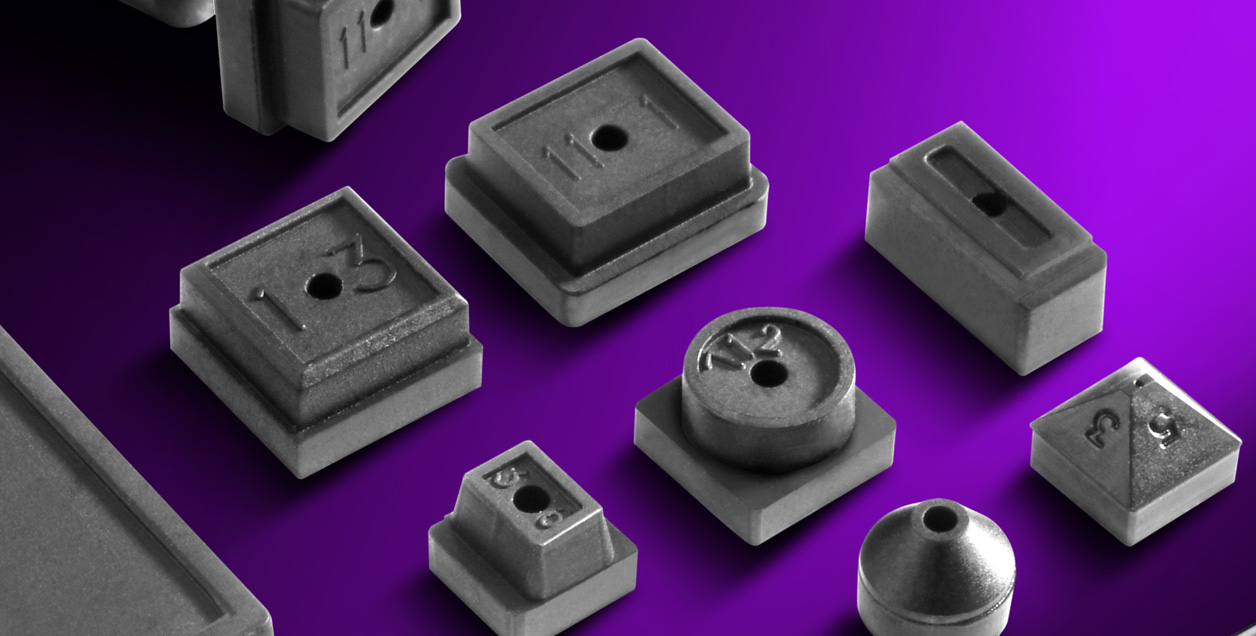

MMH designs, manufactures and markets high precision parts and tools used in process-critical applications for the semiconductor and other high technology industries.

The Group’s strategy is to relentlessly pursue product and operational improvements while providing fast, effective and local support to its customers worldwide.

In addition to designing and manufacturing a market-leading range of consumable tools and parts used in the assembly and testing of semiconductors, the Group also engages in the contract manufacturing of precision parts and tools used in process-critical applications for the semiconductor wafer-fabrication and other high-technology industries

MMH became a public corporation and listed on the SGX-Sesdaq in Singapore in June 2003. On 22 July 2008, the listing and quotation of its shares was upgraded to the SGX Mainboard. Since its listing, the Group has received multiple awards in recognition of its high standards of corporate governance, quality of disclosure, transparency and investor relations.

Financial highlights

Revenue

| Metrics | Current | Previous |

|---|---|---|

| Revenue | -9.6% | -1.3% |

Revenue for 2023Q2 decreased by 9.6% to SGD36.9 million (2022Q2: SGD40.8 million). The decrease was mainly attributable to a fall in revenue was reflecting slower conditions in the global semiconductor industry and the difficult operating environment in China. After marking strong growth in the first half of 2022, worldwide semiconductor sales began to taper during the second half of the year. The Semiconductor Industry Association (“SIA”) said global chip sales in September 2022 decreased on a year-on-year basis for the first time since January 2020.

This metric is Unfavorable.

Earnings per share

| Metrics | Current | Previous |

|---|---|---|

| Earnings per share | -35.5% | -14.6% |

It was noted the gross profit have decreased by 19.6% to SGD17.8 million (2022Q2: SGD22.2 million). The decrease was larger than the decrease in revenue, notably as cost of sales have increase by 2.3% despite the decrease in revenue. This was due to the cost structure of MMH is largely fixed in nature.

Similarly with the decrease in gross profit, net profit have decreased by 35.5% to SGD8.4 million, cushioned by a lower income tax expense of SGD2.2 million (2022Q2: SGD3.2 million) due to tax savings with a lowered profit before income tax.

The decrease in net profit thus resulted in earnings per share to fall proportionately as well, with the basic and diluted earnings per share at SGD0.0442 as compared to SGD0.0685 for the first half of the prior year.

This is Unfavorable.

Operating Cash Flows

| Metrics | Current | Previous |

|---|---|---|

| Operating Cash Flows | +13.7% | +34.5% |

Cash flows from operations for 2023Q2 have increased by 13.7% to SGD12.2 million (2022Q2: SGD10.8 million). Extrapolated to the full year, net cash from operating activities have decreased by 2% when compared to the total operating cashflows of SGD25.2 million in FY2022. The increase in this half the year arose substantially from collection of receivables from their customers.

Despite the fall in earnings, MMH is still generating positive operating cash flows. This metric is thus Favorable.

Price-to-book ratio

| Metrics | Current | Previous |

|---|---|---|

| Price to Book Ratio | 6.51 | 5.98 |

Net Asset Value (“NAV”) of the Group as at 31 December 2022 have decrease to SGD0.372 per share. Based on the closing share price of SGD2.42 as at 3 February 2023, this translates to a Price-to-book (“P/B”) ratio of 6.51.

The reason for the significant decrease in NAV of the Group is due to dividends of SGD11.1 million paid out in November 2022. This resulted in an overall decrease in cash and cash equivalents of SGD6.9 million which plays a significant portion of the decrease in NAV. The high P/B ratio translates to paying a huge premium for MMH business. In the scenario of a liquidation, investors will only be getting back 15% of the price they have paid.

This is Unfavorable.

Debt-to-equity ratio

| Metrics | Current | Previous |

|---|---|---|

| Debt-to-equity ratio | 26.9% | 21.7% |

With total liabilities of SGD13.9 million and equity of SGD51.7 million, debt-to-equity ratio have increased to 26.9% as at 31 December 2022. The increase was also notably due to the decrease in assets while liabilities remain relatively unchanged.

This metrics is Favorable however as MMH is less reliant on external sources to fund operations.

Interest coverage

| Metrics | Current | Previous |

|---|---|---|

| Interest coverage | Unlimited | Unlimited |

The interest coverage stands at Unlimited as at 31 December 2022, using profit before tax of SGD8.4 million and finance costs of Nil. This is due to the Group has no external borrowings, which is a good position to be at in view that interest rates will continue to rise as the world looks to tackle inflation.

The metric is Favorable.

Sustainable dividend yield

| Year | Yield | Total |

|---|---|---|

| 2023 | 2.48% | SGD 0.060 |

| 2022 | 5.79% | SGD 0.140 |

| 2021 | 5.79% | SGD 0.140 |

| 2020 | 4.96% | SGD 0.120 |

| 2019 | 4.13% | SGD 0.100 |

| 2018 | 4.13% | SGD 0.100 |

MMH have declared a dividend of SGD0.060 to be paid out in February 2023, consistent with the payout in in the previous financial year. Based on the closing share price of SGD2.42 as at 3 February 2023 and a dividend payout for the calendar year of SGD0.140 per share, this translates to a dividend yield of 5.79%. Which is comparable with Real Estate Investment Trusts (“REITs”) whose mandates are to distribute majority of their earnings as dividends.

It was worth noting however that the dividend payout has been more than their earnings per share throughout history. Assuming no change in dividend for 2023 as compared to 2022, the FY2023 earnings per share is lower than the total dividend declared for the previous financial year.

In prior years, this is made possible given that depreciation expense, which is a non-cash expense, can be used to adjust the net profit into net profit before depreciation. The adjusted earnings per share will then be more than sufficient to cover the dividend payout.

This is currently not the case however for FY2023 as the adjusted earnings per share for the first half is at SGD0.068 per share. If extrapolated to the full year will be SGD0.136, which is slightly below the payout for calendar year 2022 of SGD0.140. Workings as below.

| Description | Amount |

|---|---|

| Net Profit | SGD 6,143,648 |

| Depreciation adjustment | SGD 3,374,478 |

| Adjusted net profit | SGD 9,518,126 |

| Number of shares | 139,031,881 |

| Adjusted earnings per share | SGD0.068 per share |

Given the insufficient adjusted earnings per share, there is a possibility that dividend will be cut for the calendar year 2023.

Furthermore, the issue with this is management signaling that there is not much capital expenditure required to replace their assets. Annual repair and maintenance will be sufficient to maintain their assets, which is cheaper than purchasing a new asset. Investors will need to take note if they are comfortable with the idea that their assets are able to last longer than the pre-determined useful lives as at 31 December 2022.

Although from their dividend history MMH have been increasing their dividend payout since 2015, that may change over the next few years as the industry continues to face a slowdown. With even the adjusted earnings per share decreasing, dividend may be cut for 2023.

The current dividend yield of 5.79% is thus Neutral.

Key things to note

Cooling semi-conductor industry

As noted over the last few months, the significant growth of MMH in FY2022 was on the back of a bullish semi-conductor industry. However, the trend did not continue into 2023, as demand for chips normalizes and sales is expected to drop.

Website: Global semiconductor revenue to shrink by 4% in 2023, the first contraction since 2019

Semi-conductor trends are cyclical in nature. The booming industry naturally attracts new entrants, who will then compete players for market share. Whilst MMH only deals indirectly with semi-conductor, their services may also face competition for the next few years, which in turn could erode their financial performance. It will not be surprising if FY2022 and FY2021 were one-off events, and that subsequent years may see a significant decline in financial performance.

China restrictions

China’s zero tolerance approach to Covid-19 have definitely affected MMH in the first half of FY2023. However over the last few months, China have made a sharp U-turn on their policies and lifted the majority of their restrictions.

Website: China abandons key parts of zero-Covid strategy after protests

The overall view is that this might be a good sign for MMH as they are reliant on China for sales. There may be some indirect restrictions in place while China adapt to the new environment and MMH may not be able to immediately capitalize on this to produce a stable FY2023 result. However moving forward, recovery may be expected in FY2024 and beyond.

Summary

| Metrics | Financials | Rating |

|---|---|---|

| Revenue | -9.6% | Unfavorable |

| Earnings per share | -35.5% | Unfavorable |

| Operating Cash Flows | +13.7% | Favorable |

| Price to Book Ratio | 6.51 | Unfavorable |

| Debt-to-equity ratio | 26.9% | Favorable |

| Interest coverage | Unlimited | Favorable |

| Overall | | Neutral |

MMH results definitely showed they have not been spared during the last months. As the macro-environment is expected to remain uncertain for extended periods of time, investors do need to keep an eye out for any new information relating to their operations.

However with the exception of my expected dividend cut, MMH is still a company with strong results and can provide stable dividend payouts. The current weakness and downtrend in share price may provide upcoming opportunities for those considering to add for its long term sustainable dividend payout and ride the semi-conductor recovery when it happens a few years later.

The China re-opening may present opportunities for MMH to recover lost revenue in the first half of FY2023, continue expanding their footing in the market and grow the business over the next few years.

Disclaimer: Not financial advice. All data and information provided on this site is for informational purposes only.

Previous Post

Website: Micro-Mechanics Holdings Limited (SGX: 5DD): 2023 First Quarter Result