On 30 January 2023, CDL Hospitality Trusts (“CDLHT”) have announced their full year result. The hospitality sector has seen some recovery from the effects of Covid-19, and there is more room for improvement as they have not fully maximize their assets currently.

For CDLHT, it is worth noting that there was a significant improvement in their recurring DPU. Despite the significant one off capital distribution in the previous financial year, the DPU have seen an overall increase for FY2022. Their financial position have also improved slightly with the lowered gearing ratio and extended debt maturity profile from the previous quarter. It may make for an attractive investment for the near mid-term horizon.

Website: Financial Statements And Related Announcement::Full Yearly Results

Background

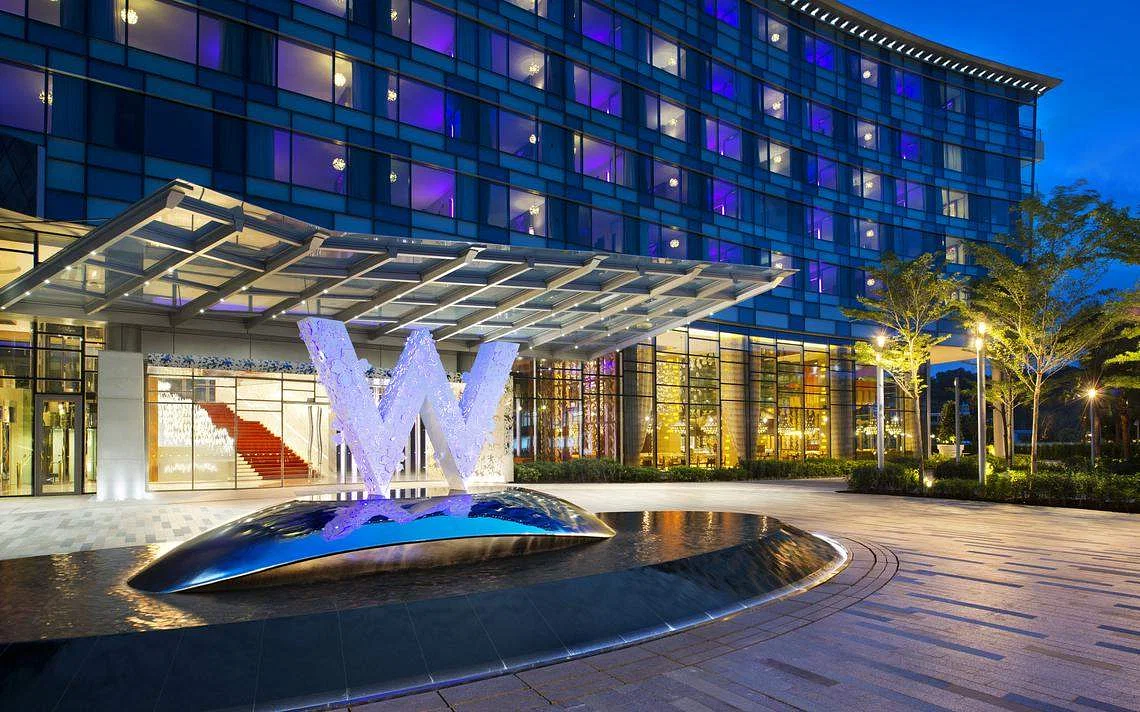

CDLHT is one of Asia’s leading hospitality trusts with assets under management of about SGD3.1 billion as at 31 December 2022. It comprises CDL Hospitality Real Estate Investment Trust (“H-REIT”), a real estate investment trust, and CDL Hospitality Business Trust (“HBT”), a business trust. CDLHT was listed on the Mainboard of the Singapore Exchange Securities Trading Limited on 19 July 2006, with H-REIT being the first hotel real estate investment trust in Asia (ex Japan).

H-REIT’s principal investment strategy is to invest in a diversified portfolio of income-producing real estate, which is primarily used for hospitality, hospitality-related and other accommodation and/or lodging purposes (including, without limitation, hotels, serviced apartments, resorts, motels, other lodging facilities and properties used for rental housing, co-living, student accommodation and senior housing) globally.

HBT’s principal investment strategy is to invest in a diversified portfolio of real estate or development projects, which is or will be primarily used for hospitality, hospitality-related and other accommodation and/or lodging purposes (including, without limitation, hotels, serviced apartments, resorts, motels, other lodging facilities and properties used for rental housing, co-living, student accommodation and senior housing) globally and may also include the operation and management of the real estate assets held by H-REIT and HBT.

CDLHT is managed by M&C REIT Management Limited and M&C Business Trust Management Limited, subsidiaries of Millennium & Copthorne Hotels Limited, an internationally recognised hospitality group, which owns and operates hotels globally.

Key Metrics

Distribution Per Unit (“DPU”)

| Metrics | Current | Previous |

|---|---|---|

| Distribution Per Unit | +31.9% | No Info |

DPU have increased by 31.9% to SGD0.0563 per share from SGD0.0427. This takes into consideration the one off capital distribution of sale proceeds from past divestments in FY2021. Excluding this, DPU have increased by 72.7%. The overall metric is Favorable as there are signs of recovery from Covid.

Occupancy

| Metrics | Current | Previous |

|---|---|---|

| Occupancy | No Info | No Info |

Based on the announcement on 30 January 2023, occupancy rate was not included in the result announcement.

Gearing ratio

| Metrics | Current | Previous |

|---|---|---|

| Gearing Ratio | 36.6% | 39.4% |

Gearing ratio stands at 36.6% as at 31 December 2022. This to me is considered Favorable as there have been improvements from the previous quarter. As the hospitality sector stabilize from the effects of Covid-19, the metric is likely to improve further and provide sufficient headroom from the MAS limit of 50%.

Interest coverage

| Metrics | Current | Previous |

|---|---|---|

| Interest Coverage | 3.7x | 3.7x |

The interest coverage for the trailing 12 months stands at 3.7 times. This is not surprising given that the hospitality sector has not fully recovered from Covid-19 and their earnings are still at low levels. The overall metric is Unfavorable as the interest coverage is lower than my preference of 5.0 times and may worsen, as the Federal Reserve on 22 March 2023 has hiked the interest rates to a range between 4.75% and 5.00%.

Website: Fed hikes rates by a quarter percentage point, indicates increases are near an end

As the interest rate may potentially increase further, CDLHT may be subjected to significant change in their cost of debt in the near future. In their presentation they have mentioned that 55.9% of their debt is also on fixed rates.

I have thus performed a sensitivity analysis using the information as at 31 December 2022:

| Description | Amount (SGD’000) |

|---|---|

| Total Debt | $1,085,300 |

| Debt Not Hedged (%) | 44.1% |

| Debt at Floating Rate Exposed | $478,617 |

| Distributable Income FY2022 | $69,700 |

Interest rate sensitivity analysis as below:

| Change in Interest Rates | Decrease in Distributable Income (SGD’000) | Change as % of FY2022 Distribution |

|---|---|---|

| + 50 bps | -$2,393 | -3.4% |

| + 100 bps | -$4,786 | -6.9% |

| + 150 bps | -$7,179 | -10.3% |

| + 200 bps | -$9,572 | -13.7% |

| + 250 bps | -$11,965 | -17.2% |

| + 300 bps | -$14,359 | -20.6% |

Do note the above is my estimation which may be different from management’s estimation. Nonetheless, if the interest rates were to increase by the basis points above, CDLHT may experience a fall in DPU accordingly. Due to their lower earnings as compared to the other sectors, any further increase in interest rates will have a more pronounced impact on their distributable income. Something investors should take note of.

Debt maturity profile

| Metrics | Current | Previous |

|---|---|---|

| Debt Maturity Profile | 2.0 years | 1.7 years |

Weighted average term to maturity of their debt stands at 2.0 years as at 31 December 2022. This is Neutral. Their current blended cost of debt has increased to 3.5% from 2.5% in the previous quarter. The significant increase is not unexpected as they have taken on new debt at the current interest rates in the market, which also resulted in the increase in debt maturity profile.

My expectation is that the high interest rates will only drop around 2 years later. CDLHT may have to re-finance their remaining debt at rates that are unfavorable which will in turn worsen the other metrics.

Price to Book Ratio

| Metrics | Current | Previous |

|---|---|---|

| Price to Book Ratio | 0.83 | 0.95 |

The Price to Book (“P/B”) ratio currently stands at 0.83. This is computed using the closing share price of SGD1.19 on 31 March 2023 and the net asset value per share of SGD1.44 as at 31 December 2022. The P/B ratio is Favorable.

Dividend yield

| Year | Yield | Total |

|---|---|---|

| 2023 | 3.02% | SGD 0.036 |

| 2022 | 4.29% | SGD 0.051 |

| 2021 | 3.92% | SGD 0.047 |

| 2020 | 5.35% | SGD 0.064 |

| 2019 | 7.66% | SGD 0.091 |

| 2018 | 7.92% | SGD 0.094 |

The dividend paid in the first half of 2023 amounted to SGD0.036 per share while the dividend paid in the second half of 2022 is at SGD0.020 per share. The total expected dividend would be around SGD0.056 per share. This is a conservative estimate as the dividend is expected to increase with the operations returning to pre-Covid level.

At 31 March 2023, with a closing share price of SGD1.19 and expected dividend payout of SGD0.056 for the full calendar year 2023, this translates to a dividend yield of 4.71%. The dividend yield is Unfavorable. For my benchmark, a general reasonable range would be around an average of 5.5% to 6.5% in the current environment. CDLHT lower dividend yield is not unexpected given that the hospitality sector have not recovered as compared to the other sectors.

Website: Reasonable Dividend Yield 2023Q2

CDLHT did not saw a significant decrease in share price recently unlike the other REITs. This is due to the hospitality sector continues to be affected and CDLHT share price had not seen a significant price appreciation in the last 2 years since the market crash in March 2020. This suggests that investors have found a strong price support at the current levels to ride for the long-term recovery.

If using dividend yield of 5.5% as a benchmark, based on the dividend of SGD0.056 there is potential for CDLHT to see its share price drop by 14.4% to SGD1.02. Investors will thus need to be mentally prepared that the share price might further fall.

| Yield | Share Price | Downside |

|---|---|---|

| Current (4.71%) | 1.19 | – |

| 5.50% | 1.02 | -14.4% |

| 6.50% | 0.86 | -27.6% |

| 7.50% | 0.75 | -37.3% |

| 8.50% | 0.66 | -44.6% |

It is worth noting that interest for long-term safe assets have stabilized and is on a small uptrend. The April 2023 Singapore Savings Bond being issued with a 10-year average interest rate of 3.15%, which while it is lower than most of the previous few months, is higher than the March 2023 bond. There is a chance for interest rates to further increase, and the required dividend yield of investor may be higher than current.

Website: SBAPR23 GX23040S Bond Details

CDLHT may be able to improve their financial performance over the next few quarters as they tourism improves. However for this quarter, the dividend yield is Unfavorable.

Summary

| Metrics | Financials | Rating |

|---|---|---|

| Distribution Per Unit | +31.9% | Favorable |

| Occupancy | No Info | N/A |

| Gearing Ratio | 36.6% | Favorable |

| Interest Coverage | 3.7x | Unfavorable |

| Debt Maturity Profile | 2.0 years | Neutral |

| Price to Book Ratio | 0.83 | Favorable |

| Overall | | Favorable |

Overall, the metrics indicate that it is favorable to invest in CDLHT. The share price continues to remain depressed as safe assets continue to provide high interest rates and the dividend yield continues to remain low. Nonetheless, it also provides opportunities for investors to buy the shares at cheaper prices with the view that the hospitality sector may recover in due course. The hospitality sector has seen some recovery from the effects of Covid-19, and there is more room for improvement as they have not fully maximize their assets currently.

CDLHT is a higher risk higher reward investment where investors may be able to higher earn capital appreciation and increased dividend payouts as compared to the other investments.

Disclaimer: Not financial advice. All data and information provided on this site is for informational purposes only.

Previous Post

Website: CDL Hospitality Trust (SGX: J85): 2022 Third Quarter Business Update

One thought on “CDL Hospitality Trust (SGX: J85): 2022 Full Year Result”

Comments are closed.