The dividend from Micro-Mechanics Holdings Limited (“MMH”) is coming in this week and it sure is a juicy amount. Holding on to this as one of my dividend stocks with a stronger growth potential than financial institute nor Real Estate Investment Trust.

Not withstanding the one-off run of share price up to SGD4.03, they had an impressive annual share price appreciation of 23.85% as at 12 November 2021. This is excluding their dividend yield of 4.35%, and when combined is definitely appealing. Nonetheless we will be having a look at their financials to see if it is sustainable.

Background

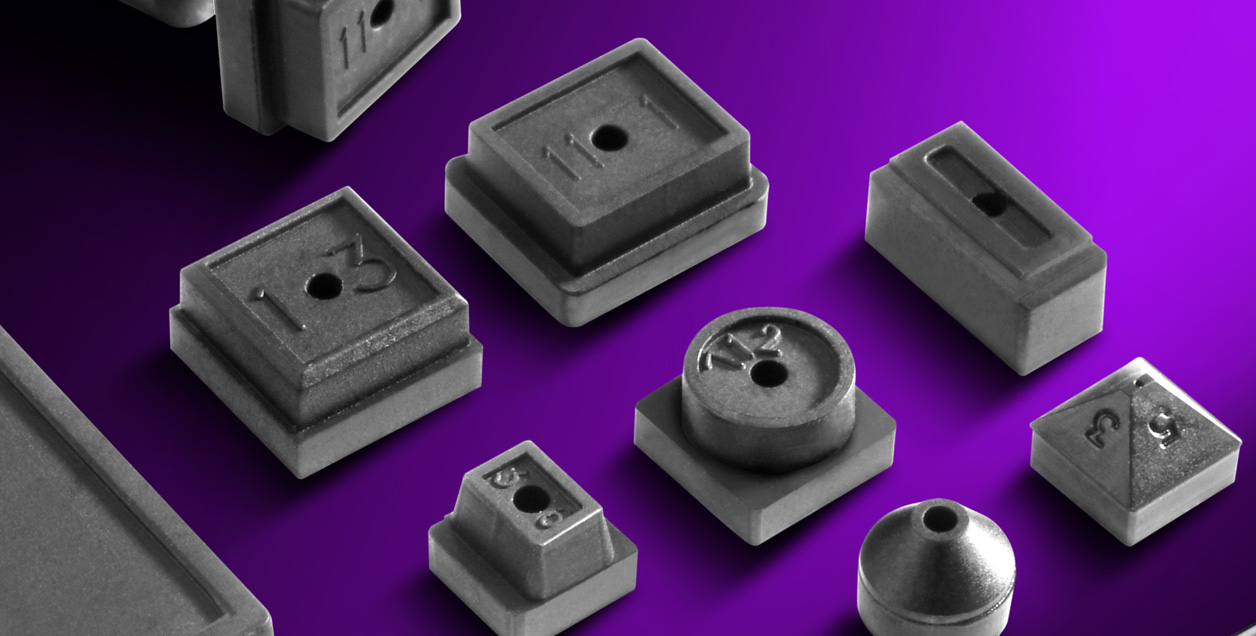

MMH designs, manufactures and markets high precision parts and tools used in process-critical applications for the semiconductor and other high technology industries.

The Group’s strategy is to relentlessly pursue product and operational improvements while providing fast, effective and local support to its customers worldwide.

In addition to designing and manufacturing a market-leading range of consumable tools and parts used in the assembly and testing of semiconductors, the Group also engages in the contract manufacturing of precision parts and tools used in process-critical applications for the semiconductor wafer-fabrication and other high-technology industries

MMH became a public corporation and listed on the SGX-Sesdaq in Singapore in June 2003. On 22 July 2008, the listing and quotation of its shares was upgraded to the SGX Mainboard. Since its listing, the Group has received multiple awards in recognition of its high standards of corporate governance, quality of disclosure, transparency and investor relations.

Financial highlights

Revenue

Based on the FY2021 annual report released on 30 September 2021, it was noted the revenue increased by 15% to SGD73 million (FY2020: SGD64 million). This is higher than their revenue average since FY2016 of around SGD61million.

While the increase is definitely positive news, it is worth noting that MMH is in the semi-conductor industry, where price have increased substantially due to the shortage around the world. MMH being able to capitalize on this is definitely a Favorable aspect of the dividend stock. It remains to be seen if the semi-conductor shortage will be resolved in the near future.

Earnings per share

Gross profit increased by 17% to SGD40 million (FY2020: SGD34 million) while gross profit margin remained relatively consistent at 54%, close to the 6 year average of 55%.

Net profit have also increased by 23% to SGD 18 million (FY2020: SGD14 million), while net profit margin remained relatively consistent at 24%, similar to the 6 year average.

With the increase in profit, the Basic and Diluted earnings per share for FY2021 have increased by 23% to SGD0.1299 per share (FY2020 SGD0.1054 per share). This is Favorable as in view of the rising costs in the macro environment, MMH have been able to maintain their respective margins and increase their earnings per share on the back of the increased revenue. This will help to sustain their dividend payout and capital expansion as required.

Operating Cash Flows

Net cash generated from operating cash flows have increased to SGD25 million in FY2021 compared to SGD18 million in FY2020. This represents an increase by 37% from the prior year.

Perusing through their financial statements, there is no significant changes noted. The improvement in net cash from operating activities is on the back of their improved profit for the year. This is thus Favorable.

We need to keep in mind however that the net cash from operating activities for FY2021 is significantly higher than the 6 year average, due to them capitalizing on the semi-conductor shortage. We will need to keep an eye-out to see if it is sustainable for their dividends.

Price-to-book ratio

Net Asset Value (“NAV”) of the Group as at 30 June 2021 have remained relatively consistent at SGD0.416 per share (FY2020: SGD0.417). Based on the closing share price of SGD3.220 as at 12 November 2021, this translates to a Price-to-book (“P/B”) ratio of 7.74.

This definitely raises eyebrows as it translates to paying a huge premium for MMH business. Even within the industry peers listed on SGX, they are significantly more expensive as detailed below.

This is Unfavorable. In the scenario of a liquidation, investors will only be getting back 13% of the price they have paid.

Debt-to-equity ratio

Debt-to-equity ratio have increased slightly to 25% as at 30 June 2021 compared to the previous financial year of 23%. This is also higher than their 6 year average of 21%.

It was worth nothing for FY2017, the amount has been restated with the adoption of SFRS(I) 16 Leases for right-of-use assets and lease liabilities. This amounted to SGD1.8 million of assets and liabilities respectively.

No adjustment is required for FY2016, however we have included the adjustment below as well to present a clearer comparative. The amount of SGD1.8 million is deemed reasonable due to no significant changes in MMH business. The 6 year debt-to-equity ratio average is thus at 22%.

Whilst the current debt-to-equity ratio is still higher than average, nonetheless the metrics is still Favorable as MMH is less reliant on external sources to fund operations. With the profitable continuing operations, this can be further lowered in the near future.

Computation as below:

Sustainable dividend yield

Based on the closing share price of SGD3.22 as at 12 November 2021, the payout of SGD0.014 per share in FY2021 translates to a dividend yield of 4.35%. Which is comparable with Real Estate Investment Trusts (“REITs”) whose mandates are to distribute majority of their earnings as dividends. This is a Favorable dividend yield.

From their dividend history, MMH have been increasing their dividend payout since 2015. It was worth noting however that the dividend payout has been more than their earnings per share throughout history. This is made possible given that depreciation expense, which is a non-cash expense, amounted to SGD6.8 million in FY2021.

Adjusting the net profit into net profit before depreciation would result in the adjusted earnings per share below, which are more than sufficient to cover the dividend payout.

The issue with this however, is management signaling that there is not much capital expenditure required to replace their assets. Annual repair and maintenance will be sufficient to maintain their assets, which is cheaper than purchasing a new asset. Investors will need to take note if they are comfortable with the idea that their assets are able to last longer than the pre-determined useful lives as at 30 June 2021.

Key things to note

Booming semi-conductor industry

The significant growth of MMH in FY2021 was on the back of a bullish semi-conductor industry. This trend is expected to minimally continue into 2022, where there are prevalent chip shortages due to the significant increased use in technology, which is deepened due to Covid-19.

Website: Chip prices set to rise into 2022 as TSMC hikes rates

However, such trends are cyclical in nature and historically, a booming industry naturally attracts new entrants, who will then compete players for market share. Whilst MMH only deals indirectly with semi-conductor, their services may also face competition for the next few years, which in turn could erode their financial performance. It will not be surprising if FY2021 was a one-off event, and that subsequent years may see a decline in financial performance.

Supply chain disruptions

There has been constant supply chain disruptions since the beginning of the pandemic. This has been further exacerbated recently, with surging demand, widespread supply constraints and even labor shortages. Whilst MMH is not affected yet for FY2021, it may be worth taking note of as we enter 2022.

Website: Longer Delivery Times Reflect Supply Chain Disruptions

Summary

In conclusion, MMH is a company with strong results along with sustainable dividend payouts. In view of the impact of Covid-19, MMH has proven itself to be a reliable defensive stock riding on the semi-conductor trend in today’s volatile market.

I believe the closing share price of SGD3.22 as at 12 November 2021 to be Under Valued, and the stock is a good option for those considering to add for its long term sustainable dividend payout. However, as Covid-19 is expected to continue for extended periods of time, investors do need to keep an eye out for any possible new moving forward relating to their operations. Notably, a possible significant increase in number of new competitors.