On 30 October 2023, Micro-Mechanics Holdings Limited (“MMH”) have announced the first quarter results for FY2024. The results show that they have stabilised when compared to 2023Q4, which is a good sign. It remains to be seen if there will be opportunities for them to improve their financial performance over the next few years and increase their dividends again. As the bulk of the cost of sales for MMH is largely fixed in nature, should revenue increase it may cause a significant increase in net profit. Investors will need to take note however that, similarly, should revenue decrease, net profit will fall more than proportionately as well.

Website: Financial Statements And Related Announcement::First Quarter Results

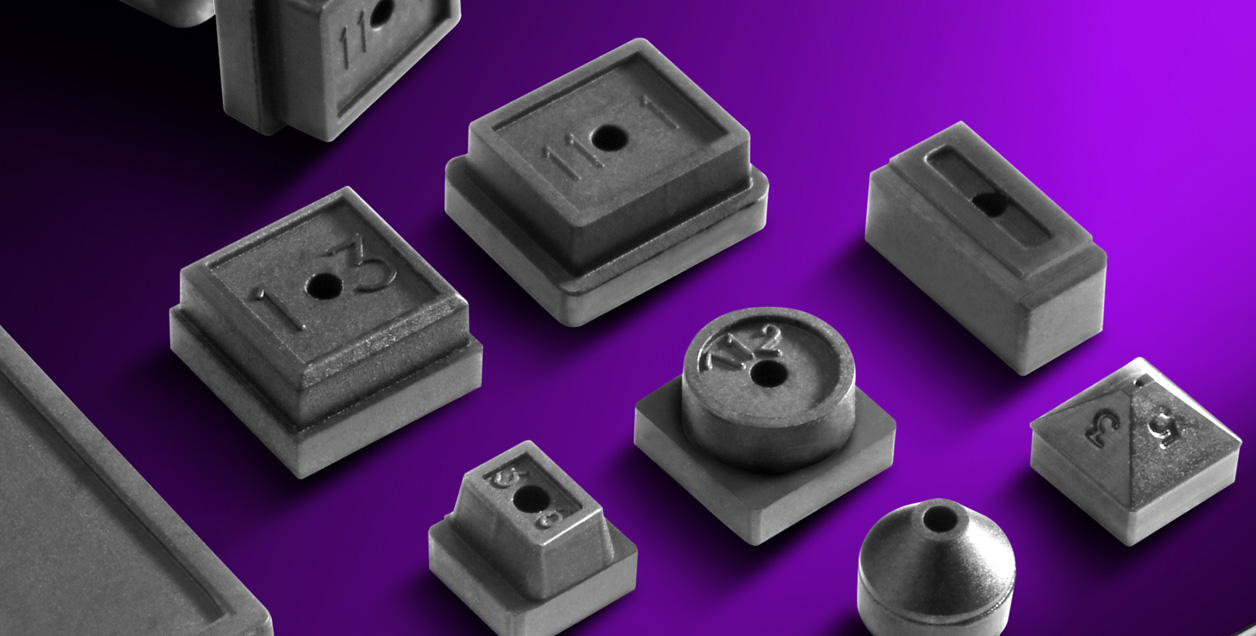

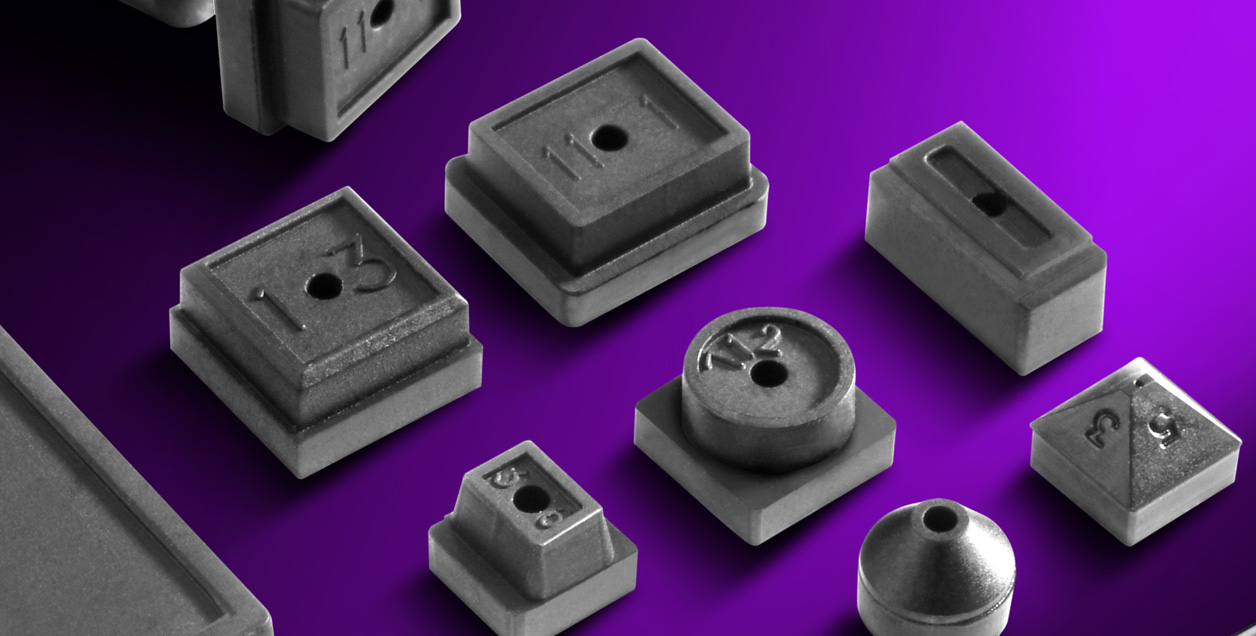

Photo source: https://www.micro-mechanics.com/

Background

MMH designs, manufactures and markets high precision parts and tools used in process-critical applications for the semiconductor and other high technology industries.

The Group’s strategy is to relentlessly pursue product and operational improvements while providing fast, effective and local support to its customers worldwide.

In addition to designing and manufacturing a market-leading range of consumable tools and parts used in the assembly and testing of semiconductors, the Group also engages in the contract manufacturing of precision parts and tools used in process-critical applications for the semiconductor wafer-fabrication and other high-technology industries.

MMH became a public corporation and listed on the SGX-Sesdaq in Singapore in June 2003. On 22 July 2008, the listing and quotation of its shares was upgraded to the SGX Mainboard. Since its listing, the Group has received multiple awards in recognition of its high standards of corporate governance, quality of disclosure, transparency and investor relations.

Financial highlights

Revenue

| Metrics | Current | Previous |

|---|---|---|

| Revenue | -21.5% | -18.7% |

Revenue for the first quarter of FY2024 decreased by 21.5% to SGD15.8 million from SGD20.1 million in the previous financial year. This metric is Unfavorable. Keep in mind however that 2023Q1 had a relatively normal quarter compared to the previous year. The revenue of SGD15.8 million for 2024Q1 is similar to the revenue of SGD15.1 million in 2023Q4. Therefore there is no drastic change. However investors need to keep an eye out for any potential changes.

Earnings per share

| Metrics | Current | Previous |

|---|---|---|

| Earnings per share | -36.4% | -50.7% |

Net profit has decreased by 36.4% to SGD2.7 million. The decrease in net profit thus resulted in earnings per share to fall proportionately as well, with the basic and diluted earnings per share at SGD0.0194 as compared to SGD0.0305 in the previous financial year. This is Unfavorable.

The significant decrease was mainly due to a decrease in gross profit by 24.9% to SGD7.7 million from SGD10.3 million. The decrease was larger than the decrease in revenue, notably as cost of sales have only decrease by 17.9% despite the larger decrease in revenue. This was due to the cost structure of MMH is largely fixed in nature.

Take note however, similar to revenue this significant decrease was due to comparison with 2023Q1. There is an increase of 35.5% when compared to the prior quarter 2023Q4.

Operating Cash Flows

| Metrics | Current | Previous |

|---|---|---|

| Operating Cash Flows | -41.7% | -29.8% |

Cash flows from operations for the first quarter have decreased by 41.7% to SGD3.5 million from SGD6.1 million in the previous financial year. The decrease was substantially from the reduction of the profit for the financial year with no significant changes in the other cashflow items.

With the fall in earnings, MMH is not able to generate sufficient cashflows to sustain the dividend payout. Accordingly there was a dividend cut in November 2023. This metric is thus Unfavorable.

Price-to-book ratio

| Metrics | Current | Previous |

|---|---|---|

| Price to Book Ratio | 5.25 | 5.69 |

Net Asset Value (“NAV”) of the Group as at 30 September 2023 have increased to SGD0.355 per share. Based on the closing share price of SGD1.86 as at 22 December 2023, this translates to a Price-to-book (“P/B”) ratio of 5.25.

This is Unfavorable. The high P/B ratio translates to paying a huge premium for MMH business. In the scenario of a liquidation, investors will only be getting back 19% of the price they have paid.

Debt-to-equity ratio

| Metrics | Current | Previous |

|---|---|---|

| Debt-to-equity ratio | 25.0% | 25.3% |

With total liabilities of SGD12.3 million and equity of SGD49.2 million, debt-to-equity ratio have decreased to 25.0% as at 30 September 2023. This metric is Favorable as MMH is less reliant on external sources to fund operations.

Interest coverage

| Metrics | Current | Previous |

|---|---|---|

| Interest coverage | 25.8x | Unlimited |

So starting this quarter, MMH has disclosed their finance costs from lease liabilities. I have missed out on the finace costs from lease liabilities in my earlier articles so my apologies on that.

The interest coverage stands at 25.8 times as at 30 September 2023, using profit before tax of SGD3.75 million and interest expense of SGD0.151 million. The finance costs arose from their lease liabilities, as the Group has no external borrowings. This is a good position to be at in view that interest rates are looking to decrease from 2024 onwards. Therefore if they need new financing, they can do it at lower rates.

The Federal Reserve on 13 December 2023 held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond. The interest rates are therefore maintained at a range between 5.25% and 5.50%, which was increased on 26 July 2023, the highest level in 22 years.

Website: Fed holds rates steady, indicates three cuts coming in 2024

The metric is Favorable.

Sustainable dividend yield

| Year | Yield | Total |

|---|---|---|

| 2023 | 4.84% | SGD 0.090 |

| 2022 | 7.53% | SGD 0.140 |

| 2021 | 7.53% | SGD 0.140 |

| 2020 | 6.45% | SGD 0.120 |

| 2019 | 5.38% | SGD 0.100 |

| 2018 | 5.38% | SGD 0.100 |

Based on the closing share price of SGD1.86 as at 22 December 2023 and a dividend payout for the calendar year of SGD0.090 per share, this translates to a dividend yield of 4.84%. For my benchmark, a general reasonable range would be around an average of 6.0% to 7.0% in the current environment. MMH’s dividend yield is below my benchmark.

Website: Reasonable Dividend Yield 2023Q4

If using dividend yield of 6.0% as a benchmark, based on the dividend of SGD0.090 there is potential for MMH to see its share price drop by 19.4% to SGD1.50. Investors will thus need to be mentally prepared that the share price might further fall.

| Yield | Share Price | Downside |

|---|---|---|

| Current (4.84%) | 1.86 | – |

| 6.00% | 1.50 | -19.4% |

| 7.00% | 1.29 | -30.9% |

| 8.00% | 1.13 | -39.5% |

| 9.00% | 1.00 | -46.2% |

It was worth noting however that the dividend payout has been more than their earnings per share throughout history. The dividend payout for 2023 is higher than the FY2023 earnings per share.

This is made possible given that depreciation expense, which is a non-cash expense, can be used to adjust the net profit into net profit before depreciation. The adjusted earnings per share will then be more than sufficient to cover the dividend payout. Based on the full financial year result from FY2023, adjusted earnings per share is SGD0.119 per share which is sufficient to pay the dividend of SGD0.090 per share.

| Description | Amount |

|---|---|

| Net Profit | SGD 9,770,480 |

| Depreciation adjustment | SGD 6,718,064 |

| Adjusted net profit | SGD 16,488,544 |

| Number of shares | 139,031,881 |

| Adjusted earnings per share | SGD0.119 per share |

The issue with this is management signalling that there is not much capital expenditure required to replace their assets. Annual repair and maintenance will be sufficient to maintain their assets, which is cheaper than purchasing a new asset. Investors will need to take note if they are comfortable with the idea that their assets are able to last longer than the pre-determined useful lives as at 30 September 2023.

The current dividend yield of 4.84% is thus Unfavorable.

Summary

| Metrics | Financials | Rating |

|---|---|---|

| Revenue | -21.5% | Unfavorable |

| Earnings per share | -36.4% | Unfavorable |

| Operating Cash Flows | -41.7% | Unfavorable |

| Price to Book Ratio | 5.25 | Unfavorable |

| Debt-to-equity ratio | 25.0% | Favorable |

| Interest coverage | 25.8x | Favorable |

| Overall | | Unfavorable |

Overall, the metrics indicate that it is unfavorable to invest in MMH. Their financial performance have definitely stabilised at the current levels. However investors will need to keep an eye out at the outlook for their industry. Should it continue to look unfavorable, this may cause the share price to fall further which will provide opportunities for those considering to add and ride the semi-conductor recovery when it happens a few years later.

Disclaimer: Not financial advice. All data and information provided on this site is for informational purposes only.

Previous Post

Website: Micro-Mechanics Holdings Limited (SGX: 5DD): 2023 Full Year Result